1. Introduction

he emergency of globalization implies that countries are becoming more integrated into the multinational economy, increasing people's interaction, information exchanges, technology transformations, and convergence in cultural activity (Li & Reuveny, 2003;Dreher, 2006). In this context, globalization is a movement in the direction of increasing world economic, political and social cultural integration through the reduction of barriers to exchange and increased international flows of capital and labour force.This involves global integration which represents the widening and deepening of the international flows of trade, capital, technology and information within a single integrated market (Petras and Veltmeyer, 2001). Gaston and Nelson (2004) argue that globalization is transformative, where it reconstitutes and restructures the economic and political configuration of the world. In this line, the theoretical argument for linking globalization to growth and energy demand is that a higher the degree of openness (a measure of globalization) of an economy may lead to increased external competitiveness and strong linkage of an economy in trade and investment (domestic and foreign) with rest of the world, which indirectly implies for higher economic growth. Thus, the effect of globalization depends on the net effects of openness on economic growth as there could be a net effect of energy consumption on economic growth and also the effect of openness on energy consumption.

Globalisation has been linked to energy demand in research arena through various channels, Chang, Berdiev & Lee (2013), (its channels or dimensions of globalization) with the levels of energy consumption along with simultaneously analyzing the issue of urbanization and economic growth, globalization thus enables to progressively make people and countries become interdependent.A number of other studies between economic growth and energy consumption also relate with the issue of carbon dioxide emissions through testing of the Environmental Kuznets Curve (EKC) hypothesis (Apergis and Ozturk, 2015).

Another point of interest to researcher is the financial sector development. Financial development (broadly defined as liquidity in banking and stock markets) can affect energy consumption through a direct effect (consumers find it easier to borrow money for durable items), a business effect (greater access to financial capital which increase business activity) and a wealth effect (increased positive stock market activity increases consumer and business confidence) (Çoban and Topcu, 2013;Sadorsky, 2010Sadorsky, , 2011b)). There are some studies by Sadorsky (2010) and Sadorsky (2011b) which finds evidence that financial development measured from banking development positively influences the energy consumption for a panel of emerging economies. Shahbaz and Lean (2012) find a long run relationship between energy consumption, T economic growth, financial development, industrialization and urbanization for Tunisia. Islam et al. (2013) find evidence that financial development positively affects energy consumption in Malaysia. Xu (2012) finds evidence that financial development has a positive impact on energy consumption in China Researching further, globalization has brought the integration of economies of the world, however, there is a common debate on the issue that globalization contributes greater economic growth, standards of living, and better quality of life at the expense of natural environment Copeland & Taylor, 2004. In the meantime, globalization boosted economic development particularly in emerging Giving the increasing importance of energy in enhancing economic growth, understanding the influence of globalisation on energy consumption while controlling for the influence of relevant variables (Urbanisation, financial sector development,) helps to establish the determinants of energy demand and its modelling in emerging economies is essential in several reasons. This study is an attempt to contribute to the literature by examining different dimensions of globalization and their relation with the levels of energy demand in Nigeria. Secondly, we recognize that the economy might have experienced structural breaks at different time points during the period of study, and as a result we test for structural breaks in the integrating properties of the variables. Thirdly, a relatively new approach to cointegration Auto-regressive distributed lag (ARDL) is employed to investigate the existence of cointegration among the variables. Fourth, the robustness of the cointegration result is investigated by applying the Johansen cointegration. Fifth, the causality among the variables is tested by employing the VECM Granger causality approach.The remainder of the paper is structured as follows. Section 2 discusses the related literature review. Section 3 analyzes the theoretical framework and model construction used in the analysis. Section 4 discuses the empirical results. Section 5 summarizes the findings and provides policy implication and directions for future research.

2. II.

3. Literature Review

There is a large literature examining the nexus between energy consumption and economic growth across economies (Rodrik, 2000;Vamvakidis, 2002;Aramberri, 2009;Shahbaz, Mallick, Mahalik & Sadorsky 2016;Ozturk and Acaravci, 2010;Shahbaz et al., 2015). For example, growth changes from a change in energy consumption have been reported by Soytas and Sari (2003) for G-7 countries, Altinay and Karagol (2005) for Turkey, Narayan and Smyth (2008) for OECD countries, Ghosh (2010) for India, Odhiambo (2011) for South Africa, Vidyarthi (2013) for India and Iyke (2015) for Nigeria. Early scholars only concentrated on bi-variate relationships between economic growth and energy consumption. However, recent scholars have augmented the existing models by including additional variables to fill the gap of omitted variables and indeed, examine the contributory effects of these variables on energy-globalisation-economic growth. The existing literature on globalisation-energy economics is mainly based on three nexus; globalisation and energy demand, energy-growth nexus. We discuss these one by one below.

4. a) Evidence of Globalisation-growth link

Recent literature studies recognize that the state of economic growth is strictly determined by globalization, and plenty of evidence has been provided and policy recommendations offered. From this context, globalization is first commonly defined as a strict economic path by most previous works, but it is really a fuzzy concept with unrestrained dimensions (Rodrik, 2000;Vamvakidis, 2002;Aramberri, 2009).

5. b) Evidence of Globalisation and energy demand nexus

Chang et el (2013) examine the effect of energy exports and globalization on economic growth using the bias-corrected least square dummy variable model in a panel of five South Caucasus countries over the period of 1990-2009. Using globalization to capture economic, political and social integrations, the study found higher energy exports and globalization expand economic growth. Overall, Furthermore, the study found a greater energy exports contribute to higher growth rates in the course of globalization hence higher energy exports lead to higher growth rates in the period of increasing economic and political integration. However, Shahbaz, Mallick, Mahalik & Sadorsky (2016)empirical analysis shows that globalization reduces energy demand. Financial development is negatively linked with energy consumption but economic growth increases energy demand. The long run causality analysis indicates the bidirectional causality between globalization (economic, political and social globalization) and energy consumption. In all energy contributes to the globalization of the world.

6. c) Evidence of Energy-growth nexus

Over the past decades, the relationship between economic growth and energy consumption has been a topic of academic interest among energy economists, and policy makers in the energy growth. The fundamental question of this research is to know whether there is a causal relationship between economic growth and energy demand. This question has led to four testable hypotheses, (a) growth hypothesis, (b) conservation hypothesis, (c) feedback hypothesis and (d) neutrality hypothes. First, the unidirectional causality running from energy use to economic growth is called "growth hypothesis," which posits that energy is a key determinant of economic

7. 12

8. ( E )

activity and reduction in energy supply will reduce economic growth (see, Ozturk and Acaravci, 2010;Shahbaz et al., 2015). For example, growth changes from a change in energy consumption have been reported by Soytas and Sari (2003) for G-7 countries, Altinay and Karagol (2005) for Turkey, Narayan and Smyth (2008) for OECD countries, Ghosh (2010) for India, Odhiambo (2011) for South Africa, Vidyarthi (2013) for India and Iyke (2015) for Nigeria.

Second, the so-called "feedback hypothesis" states that economic growth is the cause of energy consumption just as energy consumption is also a cause of economic growth in the Granger sense. As an example, the interdependent relationship between energy and domestic production or economic development has been reported by Asafu-Adjaye (2000) for Asian economies, Paul and Bhattacharya (2004) 2014) for Latin America. In such a situation, policies should encourage energy exploration alongside the adoption of energy-efficient technologies in domestic production expansion. On the one hand, any reduction in energy supply will cause a decline in domestic production and ultimately a decline in economic growth. On the other hand, a decline in economic growth will cause a corresponding decrease in energy demand.

Third, the unidirectional causality running from economic growth to energy consumption is called "conservation hypothesis." Empirically, many studies provided support to the "conservation hypothesis", including Kraft and Kraft (1978) There is a small but growing literature looking at the impact of urbanization on energy consumption. See Shahbaz, Mallick, Mahalik & Sadorsky (2016). Urbanization, like industrialization, is a key component of modernization of an economy. Urbanization can affect energy use through the production effect (concentration of production in urban areas increases economic activity and also helps to achieve economies of scale in the production), mobility and transportation effect (workers are closer to their jobs, but raw material and finished products need to be transported into and out of dense urban areas), an infrastructure effect (increased urbanization increases the demand for infrastructure), and a private consumption effect (city dwellers tend to be wealthier and use more energy intense products) (Sadorsky, 2013). However, each of these effects has positive and negative impacts on energy use. Therefore, the empirical evidences on the impact of urbanization on energy consumption are mixed (e.g. Jones, 1989Jones, , 1991;;Parikh and Shukla, 1995;Poumanyvong and Kaneko, 2010;York, 2007).

9. d) Evidence of nexus between International trade and energy demand and economic growth

Lean and Smyth (2010a) investigated the relationship between economic growth, energy consumption and international trade for Malaysia by using multivariate Granger causality tests during the period, 1971 to 2006. They found strong evidence of the unidirectional Granger causality running from exports to energy consumption. In the same Shahbaz et al. (2013a) examined the relationship between energy consumption, economic growth and international trade for China during 1971-2011. They found evidence of a feedback Granger causal relationship between international trade and energy consumption. In addition, Shahbaz et al. (2013b) made a similar attempt for the Pakistan economy in investigating the causality between natural gas consumption, exports and economic growth. They found that natural gas consumption contributed to economic growth and exports. Building on international trade theory, Antweiler et al. (2001) and Cole (2006) investigated the impact of trade liberalization (an indicator of globalization) on per capita energy use for 32 developed and developing countries. He observed that trade can influence the energy consumption through the scale effect (the increased movement of goods and services on account of trade leads to economic activity and energy usage), the technique effect (trade enables technology transfer from developed to developing countries), and the composite effect (trade can affect the sector composition of an economy). He found that trade liberalization is likely to increase per capita energy use for the average country in the sample. Ozturk and Acaravci (2013) explored the relationship between economic growth, energy, financial development and trade for Turkish economy. They observed that economic growth and trade openness lead to increased energy consumption III.

10. Methodology a) Theoretical Framework

Relevant literature have it that energy demand is positively linked with the prospects of higher economic growth and development of an economy. 2009), argues that globalization (globalization effect) is considered to be one of the potential factors inducing higher economic growth and thereby, the demand for energy is expected to rise corresponding to the economic growth. Therefore, globalization process helps countries to increase their trade improves their total factor productivity and raises the standards of living which in turn improve economic growth. In line with this, Mishkin (2009); Sadorsky (2011b) has recently posited the role of financial development on energy consumption through various effects which include consumer effect, business effect and wealth effect among others. Urbanization is not left out Shahbaz (2016) argues that the system,(urbanization) can have both positive and negative effects on energy consumption. Urbanization increases economic activity and leads to economies of scale in the production of goods and services. Urbanized enters also benefit from better (more energy efficient) infrastructure and transportation networks.

11. b) Model Construction

There are several channels (e.g. income effect(real per capita income), globalization effect, financial development, and urbanization effect) which can drive the demand for energy in economies.

???? ?? = ð??"ð??"(???? ?? , ?? ?? , ???? ?? , ???? ?? ) model 1 (1)We use a log-linear transformation of the variables to reduce the effects of changing variability in the data. The empirical estimable equation of the model can be represented as:

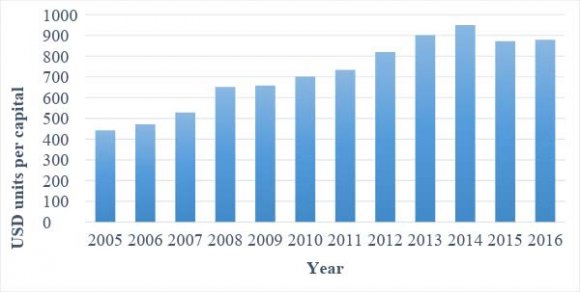

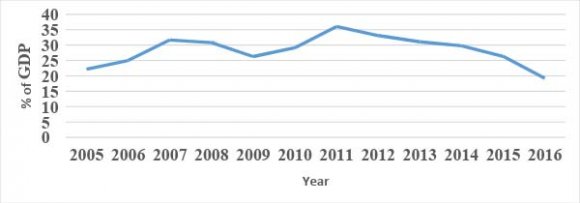

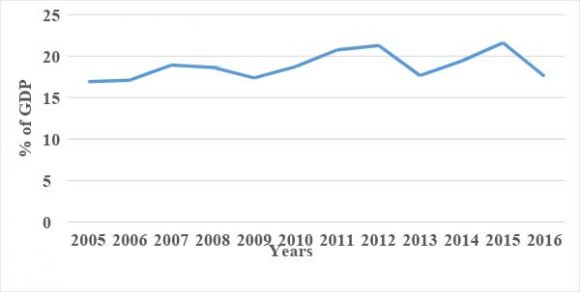

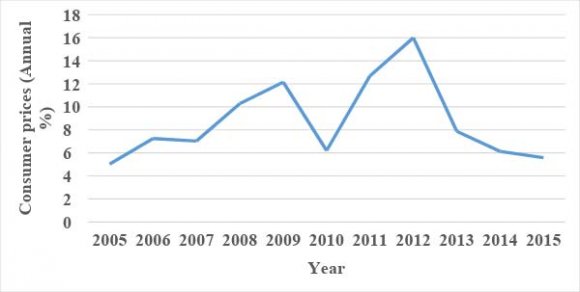

???????? ?? = ?? 1 + ?? 2 ???????? ?? + ?? 3 ?????? ?? + ?? 4 ???????? ?? + ?? 5 ???????? ?? + ?? 6 ??????????2001 ?? + ?? ??(2)This study will decompose the above equation (2) into four specifications to make provision for the various composite index for globalisation (economic, social and political). In this study, ???????? ?? is the natural log of energy consumption per capita, ?????? ?? is the natural log of real GDP per capita, ln ???????? ?? is the natural log of real domestic credit to the private sector which serves as a proxy for the financial development (FD),ln ????????t is the natural log of urban population per capita, ???????? ?? is the natural log of globalization, we have included a dummy (DUM) variable from 2001 to 2011 as a result the structural break date for the energy consumption. Thus zero variable from 1975 to 2000 and unit variable from 2001 to 2011.and ?? ?? is residual term which is assumed to follow a normal distribution. The present study uses data for the period of 1975-2011. The World Development Indicators is used to collect data on real GDP, energy consumption (kt of oil equivalent), real domestic credit to private sector and urban population. Globalization is measured by the KOF index of globalization by Dreher (2006). This index is created and maintained by ETH Zurich (http://globalization. kof.ethz.ch/). The KOF index of globalization consists of three main dimensions (economic, social and political) and an overall index of globalization. The overall globalization index is a weighted average of economic globalization (36%), social globalization (38%), and political globalization (26%). The economic globalization dimension is constructed from information on actual flows (trade, FDI, portfolio investment) and restrictions (import barriers, trade tariffs, capital account restrictions). The social globalization dimension is constructed from information on personal contact (telephone contact, tourism, foreign population. The political globalization dimension is constructed from the number of embassies, membership in international organizations, participation in U.N. Security Council missions, and international treaties. Population is used to convert the variables into per capita units except globalization which is basically an index.

12. c) Unit root Test

In time series analysis, before running the co integration test the variables must be tested for stationarity. For this purpose, we use the conventional ADF tests, the Phillips-Perron test following Phillips and Perron (1988). The ARDL bounds test is based on the assumption that the variables are I(0) or I(1). Therefore, before applying this test, we determine the order of integration of all variables using unit root tests by testing for null hypothesis ?? ?? : ?? = 0 (i.e ?? has a unit root), and the alternative hypothesis is ?? 1 : ?? < 0 . The objective is ensure that no variable is I(2) so as to avoid spurious results. In the presence of variables integrated of order two we cannot interpret the values of F statistics provided by Pesaran et al. (2001) or it will go boasted. However, these unit root tests failed to provide leading results due their low size and power, Shahbaz et el (2016). Also they failed to provide any information about structural breaks stemming in the series. We check the stationarity properties of the variables using ADF and PP

13. ( E )

with intercept and trend keeping in mind that such test is not appropriate in the presence of structural break Shahbaz et el (2016). Therefore, we apply a more robust unit root tests with structural break in the series.

14. d) Cointegration Approach

In order to empirically analyse the long-run relationships and short-run relationship between energy consumption, globalization and selected macroeconomic variables, this study apply the autoregressive distributed lag (ARDL) co integration technique as a general vector autoregressive (VAR).

The ARDL co integration approach was developed by Pesaran and Shin (1999) and Pesaran et al. (2001).This approach enjoys several advantages over the traditional co integration technique documented by (Johansen and Juseline, 1990). Firstly, it requires small sample size. Two set of critical values are provided, low and upper value bounds for all classification of explanatory variables into pure I(1), purely I(0) or mutually cointegrated. Indeed, these critical values are generated for various sample sizes. However, Narayan (2005) argues that existing critical values of large sample sizes cannot be employed for small sample sizes. Secondly, Johensen's procedure require that the variables should be integrated of the same order, whereas ARDL approach does not require variable to be of the same order. Thirdly, ARDL approach provides unbiased long-run estimates with valid t'statistics if some of the model repressors are endogenous (Narayan 2005 andOdhiambo,2008).Fourthly, this approach provides a method of assessing the short run and long run effects of one variables on the other and as well separate both once an appropriate choice of the order of the ARDL model is made, ( see Bentzen and Engsted, 2001 The ARDL model is written as follow;

????????? ?? = ?? 0 + ? ?? 1?? ????????? ???1 + ?? ??=1 ? ?? 2?? ????????? 1 ???1 + ? ?? 3?? ??????? 2 ???1 + ?? ??=0 ?? ??=0 ? ?? 4?? ????????? 3 ???1 + ?? ??=0 ? ?? 5?? ????????? 4 ???1 ?? ??=0 + ? ?? 6?? ?????? 4 ???1 ?? ??=0 + ?? 7 ???????? ???1 +?? 8 ???????? ???1 + ?? 8 ?????? ???1 + ?? 9 ???????? ???1 + ?? 10 ???????? ???1 + ?? ??(3)Where ? is the difference operator while ?? ?? is white noise or error term.We have included a dummy (DUM) variable from 2001 to 2011 as a result the structural break date for the energy consumption. Thus zero variable from 1975 to 2000 and unit variable from 2001 to 2011.The bounds test is mainly based on the joint F-statistic whose asymptotic distribution is nonstandard under the null hypothesis of no co integration. The first step in the ARDL bounds approach is to estimate the equations (3) by ordinary least squares (OLS). The estimation of this equation tests for the existence of a long-run relationship among the variables by conducting an F-test for the joint significance of the coefficients of the lagged levels of the variables. The null hypothesis of no co-integration and the alternative hypothesis which are presented below as thus:

15. Null hypothesis of no co-integration

Alternative hypothesis Equation ?? 0 : ?? 6 = ?? 7 = ?? 8 = ?? 9 = ?? 10 = 0 ?? 1 : ?? 6 ? ?? 7 ? ?? 8 ? ?? 9 ? ?? 10 ? 0 3

Source: author's design Note: all the variables defined previously Two sets of critical values for a given significance level can be determined (Narayan 2005). The first level is calculated on the assumption that all variables included in the ARDL model are integrated of order zero, while the second one is calculated on the assumption that the variables are integrated of order one. The null hypothesis of no cointegration is rejected when the value of the test statistic exceeds the upper critical bounds value, while it is not rejected if the F-statistic is lower than the lower bounds value. Otherwise, the cointegration test is inconclusive. In the spirit of Odhiambo (2009) and Narayan and Smyth (2008), we obtain the short-run dynamic parameters by estimating an error correction model associated with the long-run estimates. The equation, where the null hypothesis of no cointegration is rejected, is estimated with an errorcorrection term (Narayan and Smyth, 2006;Morley, 2006). The vector error correction model is specified as follows:

????????? ?? = ?? 0 + ? ?? 1?? ????????? ???1 + ?? ??=1 ? ?? 2?? ????????? 1 ???1 + ? ?? 3?? ??????? 2 ???1 + ?? ??=0 ?? ??=0 ? ?? 4?? ????????? 3 ???1 + ?? ??=0 ? ?? 5?? ????????? 4 ???1 ?? ??=0 + ? ?? 6?? ?????? 4 ???1 ?? ??=0 + ?? 2 ?????? ???1 + ?? 2???????? ???1 is the error correction term obtained from the cointegration model. The error coefficients (?? 1 &?? 2 ) indicates the rate at which the cointegration model corrects its previous period's disequilibrium or speed of adjustment to restore the long run equilibrium relationship. A negative and significant ?????? ???1 Volume XVIII Issue I Version I 15 ( E ) (4) coefficient implies that any short run movement between the dependant and explanatory variables will converge back to the long run relationship.

16. e) Robustness analysis with Johnson Co integration

To check the robustness of initial results of the long-run relationships that we detect from using the ARDL model, we conduct a sensitivity analyses relying on the traditional alternative estimation approaches.

?? ?? = ?? + ?? 1 ?? ???1 +??..+?? ?? ?? ????? + ?? ?? (5)Where ?? ?? is a (?? × 1) vector of selected variables in log form that are integrated at order onecommonly denoted 1(1), n=5, ?? ?? are the parameters to be estimated, ?? ?? are the random errors.This (VAR) can be re-written as;

??? ?? = ?? + ? ?? ???1 + ? Î?" ?? ??? ????? + ?? ?? ??=1 ??=1(6)Where, ? = ? ?? ?? ? 1

17. ?? ??=1

and

Î?" ?? = ? ? ?? ?? ?? ?? =??+1(7)If the coefficient matrix ? has reduced rank ?? < ??, then there exist ?? × ?? matrices of ?? and ?? each with rank ?? such that

? = ???? ?(8)Where ?? is the number of co-integrating relationship, the element is ?? is known as the adjustment parameters in the vector error correction model and each column of ?? is a cointegrating vector. It can be shown that, for a given ??, the maximum likelihood estimator of ?? define the combination of ?? ???1 that yield the ?? largest canonical correlations of ??? with ?? ???1 after correcting for lagged differences and deterministic variables when present. The two different likelihood ratio test of significance of these canonical correlations are the trace test and maximum eigenvalue test, shown in equation 5 and 6 respectively below

?? ?????????? (??) = ??? ? ln (1 ? ?? ?? ) ? ?? ??=??+1 (9) ?????? ?? ?????? (??, ?? + 1) = ???????(1 ? ?? ???+1 )(10)Here, T is the sample size and ?? ??? is the ?? ??? ordered eigenvalue from the ? matrix in equation 7 or largest canonical correlation. The trace tests the null hypothesis that the number of ?? co-integrating vector against the alternative hypothesis of ?? co-integrating vector where ?? is the number of endogenous variables. The maximum eigenvalue tests the null hypothesis that there are ?? cointegrating vectors against an alternative of ?? + 1 (see Brooks 2002).

18. f) Granger Causality

This study uses the Granger causality test augmented by the error correction term for detecting the direction of causality between the variables. The advantage of using vector error correction (VECM) modelling framework in testing for causality is that it allows for the testing of short-run causality through the lagged differenced explanatory variables and for longrun causality through the lagged ECM term. A statistically significant ?????? ???1 term represents the longrun causality running from the explanatory variables to the dependent variable. For instance, if two variables are non-stationary, but become stationary after first differencing and are cointegrated, the pth-order vector error correction model for the Granger causality test assumes the following equation:

??????? ?? = ?? 10 + ? ?? 11?? ????? ?? ???1 ?? 11 ??=1 + ? ?? 12?? ????? ?? ????? ?? 12 ??=1 + ?? 13 ?????? ???1 + ?? 1??(4)??????? ?? = ?? 20 + ? ?? 21?? ????? ?? ???1 ?? 21 ??=1 + ? ?? 22?? ????? ?? ????? ?? 22 ??=1 + ?? 23 ?????? ???1 + ?? 2??(5)Where ?? and ?? are the regression coefficients, ?? ?? is error term and ?? is lag order of ?? and ?? Table 4 indicates that the optimal lag order based on the Schwarz information criterion (SC) is 2. The presence of short-run and long-run causality can be tested. If the estimated coefficients of ?? in Eq. 1 is statistically significant, then that indicates that the past information of y (e.g energy consumption) has a statistically significant power to influence ?? (globalization or any selected macroeconomic variables) suggesting that ?? Granger causes x in the short-run.

The long-run causality can be found by testing the significance of the estimated coefficient of ?????? ???1 (?? 23 ).

19. g) Stability and Diagnostic test

To ensure the goodness of fit of the model, diagnostic and stability tests are conducted. Diagnostic tests examine the model for serial correlation, functional form, non-normality and heter oscedasticity. The stability test is conducted by employing the cumulative sum of recursive residuals (CUSUM) and the cumulative sum of squares of recursive residuals (CUSUMSQ) suggested by Brown, Durbin & Evans (1975). The CUSUM and CUSUMSQ statistics are updated recursively and plotted against the break points. If the plots of the CUSUM and CUSUMSQ statistics stay within the critical bonds of a 5 percent level of significance, the null hypothesis of all coefficients in the given regression is stable and cannot be rejected. Therefore, we start with the Johansen cointegration equation which starts with the vector auto regression (VAR) of order ?? is given by: IV.

20. Empirical Result and Discussions on Finding

21. Table 1: Descriptive statistics and correlation analysis

22. Source: eview9

Table 3 (panel A &B) present the results of descriptive statistics and correlation matrix. The idea of using both descriptive statistics and correlation matrix is to enable us to know existence of normal distribution occurring among the series of energy demand function and also to gauge the degree of association between the level variables considered in the analysis. In other words, correlation matrix plays a vital role in assessing the probability of higher auto-correlation between series. We find the positive correlation between financial development and energy consumption. Economic globalisation is positively associated with energy Table 3, present the unit a robust analysis on stationary test. There is a clear evidence that all variables are integration at first difference in the presence of structural break. Therefore, the order of integration of the variables makes ARDL the preferred approach to this empirical study. The results for the unit root test are reported in table 2. All that data are transformed into the natural log form. To determine the order of integration of the variables, the ADF (augmented Dickey-Fuller) test complemented with the PP (Philips-Perron) test in which the null hypothesis is ?? ?? = ?? = 0 ( i.e?? has a unit root) and the alternative hypothesis is ?? 1 : ?? < 0 are implemented. The result for both the level and differenced variables presented in table 2.The stationarity tests were performed first in levels and then in first difference to establish the presence of unit roots and the order of integration in all the variables. The results of the ADF and PP stationarity tests for each variable show that both tests fail to reject the presence of unit root for the selected data series in level, indicating that these variables are non-stationary at levels. The first difference results show that these variables are stationary at 1% and 10% significance level (integrated of order one 1(1)) respectively, except for Urbanisation which is an indication of mixed order of integration. This is because ADF and PP are not good candidate for stationary test in the presence of structural break. Therefore, we apply unit root test with structural break The results of the co-integration test based on the ARDL-bounds testing method are presented in Table 4. Four specifications of model 1 are estimated to establish the robustness of this empirical analysis. All specifications are selected based on Schwarz information criterion (SC).As earlier stated that we would perform the test using energy consumption (????) as dependent variables, so, all-in-one we would get 4 equations (specifications). We performed F test for each of the specification and Table 4 shows those results. After deciding on lag-length, the issue on the selection of critical values (CVs) becomes imperative. The CVs of the F test depends on the sample sizes. Narayan (2005) argues that CVs of Pesaran et al (2001) that is generated for larger sample size should not be used for smaller sample size. Narayan (2005) presents CVs of the F test for smaller sample sizes with 30-80 observations. With 37 observations in our sample, we report both the 10%,5% and 1% critical values from Narayan (2005) in Table 4. The result shows that the Fstatistic is higher than the upper bound critical value from Narayan (2005) a) Sensitive analysis or Robustness analysis using Johansen cointegration Cointegration among the variables are also checked by the test proposed by Johansen and Juselius (1990). The unit root test test with structural break indicates that all of the variables are I(1) at their levels but I(0) at their 1st differenced form, which is the precondition for Johansen co integration test. This test would provide a sensitivity check on the ARDL results. The Johansen cointegration approach is also used to test for the long-run relationship. Table 5 shows the calculated as well as the critical values of Trace statistics and Maximum Eigen value statistics of Johansen test. The results indicate the rejection of null hypothesis of no cointegration at the 5% level in favour of the alternative hypothesis that there is one cointegrating vector. This finding thus confirms the existence of a long-run relationship between the selected macroeconomic variables in Nigeria, which was found by the ARDL bounds testing approach to cointegration.

23. b) Long-run and Short-run Estimates

Our empirical results from table 6 show that globalization (i.e. economic globalization, social globalization and overall globalization) has a negative impact on energy demand. It is only economic globalization that is statistically significant by 1% at -0.258 which means that 1% increase in economic globalisation will lead to 0.258 decrease in energy consumption in the long run. Overall globalisation, political and social globalisation are negative but statistically insignificant. The policy implication of this is that economic globalization, social globalization and overall globalization could contribute to less energy consumption for an emerging economy like Nigeria. Shahbaz et el (2016) reported that overall globalisation and its composite index are negative and statistically insignificant for India. Surprisingly, economic growth is statistically significant at 5% level with energy consumption in specification 2 when the combined contribution of Urbanisation and economic globalisation in the long run. It mean that a 1% rise in economic growth leads to a 0.0335% fall in energy demand in Nigeria, keeping other things constant. Our result is consistence with Zhang and Xu (2012) who found negative impact of energy use on economic growth due to the use of energy in unproductive sectors. However, studies in the likes of Erol and Chu (1987), and Yu and Jin (1992) for the case of the USA; Murray and Nan (1996) for France; Germany, India, Israel, Luxembourg, Norway, Portugal, UK, USA and Zambia; Soytas and Satri (2003) for Canada, Indonesia, Poland, USA and UK; and Akinlo (2008) for Cameroon, Cote d'Ivoire, Kenya, Nigeria, and Togo found no evidence of relationship between energy consumption and economic growth.

In terms of looking at the impact of financial development on energy demand in Nigeria, the results of our study reveal that financial development impacts energy demand insignificantly and positively. This highlights financial development is well harnessed in the macroeconomic system of Nigeria. Intuitively, it suggests that in the case of Nigeria, increasing financial development (in the form of domestic credit to the private sector) could increases economic activity in an efficient way that lowers energy consumption if properly exploited. Our study is contrary to the finding of relevant literatures due to the use of different data sets, time periods of study as well as different econometric approaches.

In examining the impact of urbanization on energy demand, it is found that a rise in urban population is significantly and positively linked with energy consumption in specification 2. A 1% increase in urban population leads to a 0.2858% increase in energy use in Nigeria. This result supports the findings of Mahalik and Mallick (2014) and Mallick and Mahalik (2014) for India and Shahbaz and Lean (2012) for Tunisia in which they reported that urbanization increases energy demand for Tunisia. This indicates there is a role for urbanization in the dynamics of energy consumption demand as urbanization is found to be one of the leading factors contributing to more energy consumption in Nigeria. This could have happened in the face of a changing Nigerian economic landscape (i.e. shifting the production base from an agricultural sector to an industrial sector).

Lastly, we have incorporated a dummy variable to account for the impact of the unknown structural break on energy demand in Nigeria and to establish the main purpose of various policy on energy intensity and strategies to increase energy conservation and improve efficiency in use. We find that the dummy various which was pegged from 2001 is positive and statistically insignificant. This implies that energy policy could have effect on demand if properly implemented.

This study centres on the importance of long run estimate on policy implementation. However, the short run results reported in the lower segment of Table 6 show that the short run deviations from the long run equilibrium are corrected by 35 to 62 percentages each year. Economic growth is significantly and positively related with energy consumption. Financial development and urbanization both mixed impact on energy consumption but are statistically insignificant. Urbanization is also inversely linked with energy demand but insignificant in specification 3. The overall measure of globalization (including its three components such as economic globalization, political globalization and social globalization) decreases energy demand significantly. Moreover, the dummy variable government policies has a negative but insignificant impact on energy demand in the short run. The R-squared confirms the high degree of contribution of explanatory variables on the dependent variable. The Dublin Watson shows evidence of no autocorrelation among the variables. The diagnostic tests in our analysis suggest that error terms of short run models are normally distributed; free from serial correlation, heteroskedasticity, and ARCH problems across all the four models. The Ramsey reset test further provides that the functional forms are well specified.

24. c) Stability tests

The stability of the long-run coefficient is tested by the short-run dynamics. Once the ECM model given in table 8 has been estimated, the cumulative sum of recursive residuals (CUSUM) and the CUSUM of square (CUSUMSQ) tests are applied to assess parameter stability (Pesaran and Pesaran, 1997). Figures (2- The VECM granger causality analysis When co integration is confirmed, there must be auni or bidirectional causality among the or variables. We follow Shahbaz et el (2013) analysis China and examine the relationship within the VECM framework with inclusion of three different measures of globalization. Such knowledge is essential for form-ulating appropriate energy policies for long term economic growth. Table 7 reports the results for the direction of causality in the long run as well as in the short run. It noted that there exists a feedback relationship between globalization and energy consumption in the long run. In the long run, globalisation Granger causes consumption, while energy consumption also Granger causes globalization in the long run. This finding is in line with Shahbaz et el (2016) for India. In such a situation, policies should encourage energy exploration alongside the adoption of energy-efficient technologies in domestic production expansion. The unidirectional causality running from energy consumption to financial development, economic is consistent with and Lijun in case of Guangdong (China) but contradictory with Islam et al. ( 2013) and, Shahbaz and Lean (2012b) who reported feedback effect between financial development and energy demand in case of Malaysia and Tunisia This is in line with energy-led-growth, hypothesis. See relevant literatures. There is unidirectional causality running from energy consumption to Urbanisation.

The short run causality estimates provides evidence that uni-directional causality is running from economic growth to energy consumption.In the short run unidirectional causality is found running from economic growth to energy. In short run, globalisation is caused by growth, financial development. Growth causes urbanization. Globalization (economic, social and causes financial development. However, while examining different dimensions of globalization (economic, social and political), we do observe that social globalisation causes economic growth while political globalisation causes consumption in Nigeria. In all globalisation remain a key determinate of energy consumption in Nigeria.

any reduction in energy supply will cause a decline in domestic production and ultimately a decline in economic growth. On the other hand, a decline in economic growth will cause a corresponding decrease in energy demand. One of the implications of this result is that any policy which discourages energy use will negatively impact economic growth for Nigeria. autoregressive distributed lag (ARDL) bounds testing cointegration procedure to examine the long run relationship between the variables. The integrating properties of the variables are investigated by applying the unit root test with unknown structural break test that accommodates a single unknown structural break stemming from the series. Johansen co integration procedure is further applied to test the robustness of our long run estimates. The long run estimates obtained from the bounds test validates the presence of cointegration between the variables. Moreover, economic growth is found to be positively linked to energy consumption with combined with the marginal contribution of economic globalisation and Urbanisation.

Financial development tends to be neutral on energy demand contrary to documented evidence from relevant literatures. Urbanization raises energy consumption when combined with the marginal contribution from economic growth and economic globalisation The overall measure of globalization thus insignificant has the potential of lowering energy demand in Nigeria. Dummy variable is positive, thus insignificant could play a role in driving energy consumption in Nigeria. In all, we establish that economic growth, Urbanisation and globalisation (economic globalisation) have some dominant role in energy consumption in Nigeria. Turning to vector error correction model (VECM), the direction of causality in the long run as well as in the short run. We found a feedback relationship between globalization and energy consumption in the long run. In the long run, globalisation Granger causes energy consumption, while energy consumption also Granger causes globalization in the long run. . The unidirectional causality running from energy consumption to financial development, economic growth. This implies that in the short run, any energy policy that discourages the use of energy would reduce economic growth and financial sector development in Nigeria. The short run causality estimates provides evidence that uni-directional causality is running from economic growth to energy consumption. A unidirectional causality is found running from economic growth to energy. Globalisation is caused by growth, financial development. Growth causes urbanization. Globalization (economic, social and political) causes financial development.

The findings from this study offer some interesting policy ideas. The observed negative but insignificant impact of (all) globalization on energy demand for the Nigerian economy, though there is negative and significant impact energy consumption favorably suggests that it is vital for the policymakers to design appropriate policies for opening up the Nigerian economy for enhancing trade relationships and attract more foreign direct investment into the economy. Therefore, The Nigerian economy should in more interested in free trade deals with the rest of the world economies is one of the steps to realize this stated objective of reducing energy consumption for this emerging economy. It is also the case that since financial development has a positive and insignificant impact on energy consumption, this has also a strong policy implication, implying that financial development is yet to explore by the stake holder in the country and should therefore be strengthened. Therefore, to achieve long run economic and reduce energy demand in Nigeria, more attention should be given to domestic credit to private sector and also better and sustainable policies should be implemented. Urbanisation has some mixed result from various specifications, though in specification 3, positive and significant Urbanisation imply that rising urbanization could may lead loss of environmental quality due to heavy pressure from urban growth. This will make it more difficult for Nigeria to achieve long run economic growth. The policy implication is for the government of Nigeria to think of an alternative mechanism for checking the growth of urban population which will help to reduce the adverse environmental effects (i.e. climate change and global warming).

| Panel A | LENR | LGLOB | LGDP | LPRCD | LURBP | LECOG | LPOLG | LSOCG |

| Mean | 6.5439 | 3.7416 | 6.1647 | 2.5356 | 17.2521 | 3.5698 | 4.3553 | 3.0149 |

| Median | 6.5385 | 3.7635 | 6.0800 | 2.5112 | 17.2863 | 3.7001 | 4.3899 | 2.9837 |

| Maximum | 6.6529 | 3.9984 | 7.8297 | 3.5664 | 18.1012 | 4.1031 | 4.5074 | 3.2988 |

| Minimum | 6.4079 | 3.4420 | 5.0309 | 1.6882 | 16.3471 | 2.8814 | 4.0101 | 2.7556 |

| Std. Dev. | 0.0563 | 0.1640 | 0.6626 | 0.4060 | 0.5210 | 0.4110 | 0.1377 | 0.1522 |

| Skewness | -0.2429 | -0.1900 | 0.7294 | 0.5443 | -0.1089 | -0.4361 | -1.0397 | 0.1423 |

| Kurtosis | 2.8231 | 1.8798 | 3.0767 | 3.4539 | 1.8662 | 1.6123 | 3.0484 | 1.9472 |

| Jarque-Bera 0.4122 | 2.1569 | 3.2901 | 2.1442 | 2.0548 | 4.1417 | 6.6701 | 1.8337 | |

| Probability | 0.8138 | 0.3401 | 0.1930 | 0.3423 | 0.3579 | 0.1261 | 0.0356 | 0.3998 |

| Panel B LENR | 1.0000 | |||||||

| LGLOB | 0.6628 | 1.0000 | ||||||

| LGDP | 0.4241 | 0.4251 | 1.0000 | |||||

| LPRCD | 0.6897 | 0.4879 | 0.4894 | 1.0000 | ||||

| LURBP | 0.8022 | 0.9397 | 0.3637 | 0.5499 | 1.0000 | |||

| LECOG | 0.6298 | 0.9135 | 0.1495 | 0.3469 | 0.9450 | 1.0000 | ||

| LPOLG | 0.6174 | 0.9062 | 0.4278 | 0.4943 | 0.7809 | 0.6999 | 1.0000 | |

| LSOCG | -0.1476 | -0.2999 | 0.6479 | 0.1893 | -0.3601 | -0.5408 | -0.2376 | 1.0000 |

| Note: all variables are in the natural log |

| *level of significance at 10% **level of significance at 5% ***level significance at 1% |

| Source: various computation from eview9 |

| P-P unit root test | ADF unit root test | ||||||||

| Variable | Constant | Constant and Trend | Constant | Constant and Trend | |||||

| t-Statistic prob | t-Statistic prob | t-Statistic prob | t-Statistic prob | ||||||

| LnER | -1.8285 | 0.3612 | -2.6527 | 0.261 | -1.8734 | 0.3406 | -2.6527 | 0.261 | |

| LnGB | -1.3382 | 0.6011 | -2.4077 | 0.3696 | -1.3317 | 0.6042 | -3.6951 | 0.0364 | |

| LnY | 0.0038 | 0.9528 | -0.4996 | 0.979 | -0.0049 | 0.952 | -0.5612 | 0.9754 | |

| LnCD | -2.0597 | 0.2614 | -2.1864 | 0.4824 | -2.5295 | 0.1174 | -1.9944 | 0.5846 | |

| LnUP | -1.8087 | 0.3705 | -1.5395 | 0.7967 | -1.0586 | 0.7209 | -2.7378 | 0.2287 | |

| Year 2018 | LnEG LnPG LnSG Î?"lnER Î?"LnGB | -1.047 -2.5694 -1.4477 -6.495*** 0.0000 0.7257 0.1085 0.5481 -5.4024*** 0.0001 | -1.7824 -3.1392 -0.6892 -6.3868*** 0.0000 0.6923 0.1129 0.9663 -5.3704*** 0.0005 | -1.1096 -2.5633 -1.2687 -6.4828*** 0.0000 0.701 0.1098 0.6333 -5.3982*** 0.0001 | -1.7824 -3.1052 -0.6304 -6.3767*** 0.0000 0.6923 0.1204 0.9708 -5.3611*** 0.0006 | ||||

| 18 | Î?"lnY Î?"LnCD | -5.7427*** 0.0000 -3.7043*** 0.0083 | -6.3453*** 0.0000 -3.6411** 0.0406 | -5.7431*** 0.0000 -4.0922*** 0.0030 | -6.3378*** 0.0000 -3.8205** 0.0279 | ||||

| Î?"LnUP | -1.5794 | 0.4823 | -1.8567 | 0.6552 | -1.5334 | 0.5052 | -1.7762 | 0.6947 | |

| Î?"LnEG | -7.4166*** 0.0000 | -7.491*** 0.0000 | -7.4312*** 0.0000 | -7.4295*** 0.0000 | |||||

| Î?"LnPG | -6.1900*** 0.0000 | -6.1988*** 0.0001 | -6.1903*** 0.0000 | -6.2012*** 0.0001 | |||||

| Î?"LnSG | -3.9495*** 0.0044 | -4.2051** 0.0110 | -3.9509*** 0.0044 | -4.2252** 0.0105 | |||||

| E ) | |||||||||

| ( | |||||||||

| Global Journal of Human Social Science - | variables LnER LnGB LnY LnCD LnUP LnEG LnPG LnSG | T-statistics -4.0938 -2.4797 -1.8671 -1.849 -3.1719 -2.2077 -2.5856 -1.837 Innovation outliers Break point 2001 1990 2001 1989 2000 1981 2008 2006 | Decision I(0) I(0) I(0) I(0) I(0) I(0) I(0) I(0) | T-statistics -7.4849*** -5.7540*** -6.9746*** -4.3802* -5.4873*** -8.3809*** -10.353*** -5.1885*** Additive outlier Break point 1988 1988 1989 1995 1988 1987 1993 1999 | Decision I(1) I(1) I(1) I(1) I(1) I(1) I(1) I(1) | ||||

| © 2018 Global Journals | |||||||||

| Source of critical value bounds: Narayan (2005) Appendix: Case II Restricted intercept and no trend for k = 4. ** indicate |

| significance at 5% level respectively. Lag length=2 |

| Source: eviews9 |

| Bound testing cointegration | |||

| Estimated models | optimal lag length | F-statistics | Decision |

| FEC(EC/GLOB,Y,CD,URP) | 1,2,1,0,0 | 4.3621** | cointegration |

| FEC(EC/EG,Y,CD,URP) | 1,2,0,0,1 | 4.2799** | cointegration |

| FEC(EC/POG,Y,CD,URP,DUM2001) | 1,0,1,0,0 | 3.5673** | cointegration |

| FEC(EC/SOGY,CD,URP) | 1,1,1,0,0 | 4.2854** | cointegration |

| critical values (T = 37) | |||

| Significant level | Lower bounds I(0) | Upper bounds I(1) | |

| 1% level | 3.969 | 5.455 | |

| 5% level | 2.893 | 4.000 | |

| 10% level | 2.427 | 3.39 |

| 1. Altinay, | G., | Karagol, | E.(2005). | Electricity |

| consumption and economic growth: evidencefrom | ||||

| Turkey. | ||||